Seguro geico is not just a household name in the world of insurance; it represents a commitment to providing quality coverage with competitive pricing. Since its founding, Geico has evolved into a leading provider of various insurance policies, catering to diverse needs. In this exploration, we will dive into the rich history of Geico, the types of insurance it offers, and the unique advantages it brings to policyholders.

The impressive range of insurance options available through Geico includes auto, home, and renters insurance, all structured to provide peace of mind for their customers. Furthermore, Geico’s dedication to customer service and innovative pricing strategies positions it as a strong contender in the insurance market, making it a preferred choice for many.

Overview of Geico Insurance

Geico, or the Government Employees Insurance Company, has established itself as a major player in the American insurance industry. Founded in 1936 by Leo Goodwin Sr. and his wife, Lillian, the company initially targeted government employees and military personnel, offering them affordable auto insurance. Over the decades, Geico has expanded its customer base and service offerings, becoming synonymous with competitive pricing and comprehensive coverage.The key features of Geico's insurance policies revolve around affordability, simplicity, and accessibility. Geico utilizes a direct-to-consumer model, allowing customers to purchase insurance online or over the phone without the need for an agent. This approach not only reduces overhead costs but also enables the company to pass savings onto its policyholders. Additionally, Geico offers a range of discounts including those for safe driving, multiple policyholders, and military service members, making their plans even more attractive.Types of Insurance Offered by Geico

Geico provides a diverse portfolio of insurance products designed to meet the varied needs of its customers. Understanding the different types of insurance offered can help individuals and families make informed decisions regarding their coverage. The following are the primary types of insurance available through Geico:- Auto Insurance: This is Geico's cornerstone product, providing coverage for personal vehicles, motorcycles, and more. The policies typically include liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Homeowners Insurance: Geico offers coverage for homes, protecting against damages from natural disasters, theft, and liability. This type of insurance can provide peace of mind for homeowners.

- Renters Insurance: For those who do not own their residence, Geico provides renters insurance to cover personal items and liability within a rented space.

- Life Insurance: Geico partners with third-party providers to offer various life insurance policies, ensuring long-term financial security for families.

- Motorcycle Insurance: This specialized insurance is tailored for motorcycle owners, offering coverage options that target the unique risks associated with riding.

- Boat Insurance: Geico also offers insurance for boats, providing coverage for various types of watercraft against damages and liability.

- Travel Insurance: Although not as widely known, Geico provides travel insurance options to protect travelers against cancellations, medical emergencies, and lost belongings.

Geico's innovative approach and commitment to customer service have played pivotal roles in its growth and widespread recognition.

Benefits of Choosing Geico: Seguro Geico

Competitive Pricing Strategies

One of the standout features of Geico is its competitive pricing strategy, which is designed to offer substantial savings compared to many other insurance providers. Geico utilizes a unique pricing model that incorporates advanced algorithms to calculate premiums, ensuring that customers receive the best possible rates based on their individual profiles. This pricing strategy can lead to significant savings, especially for safe drivers with clean records. - Geico offers discounts that can lower premiums, such as:- Multi-Policy Discounts: Customers can save by bundling auto insurance with homeowners or renters insurance.

- Safe Driver Discounts: Drivers with a clean driving record are rewarded with reduced rates.

- Military Discounts: Active and retired military personnel can benefit from special rates.

- Good Student Discounts: Students who maintain a high GPA may qualify for additional savings.

Exceptional Customer Service Features

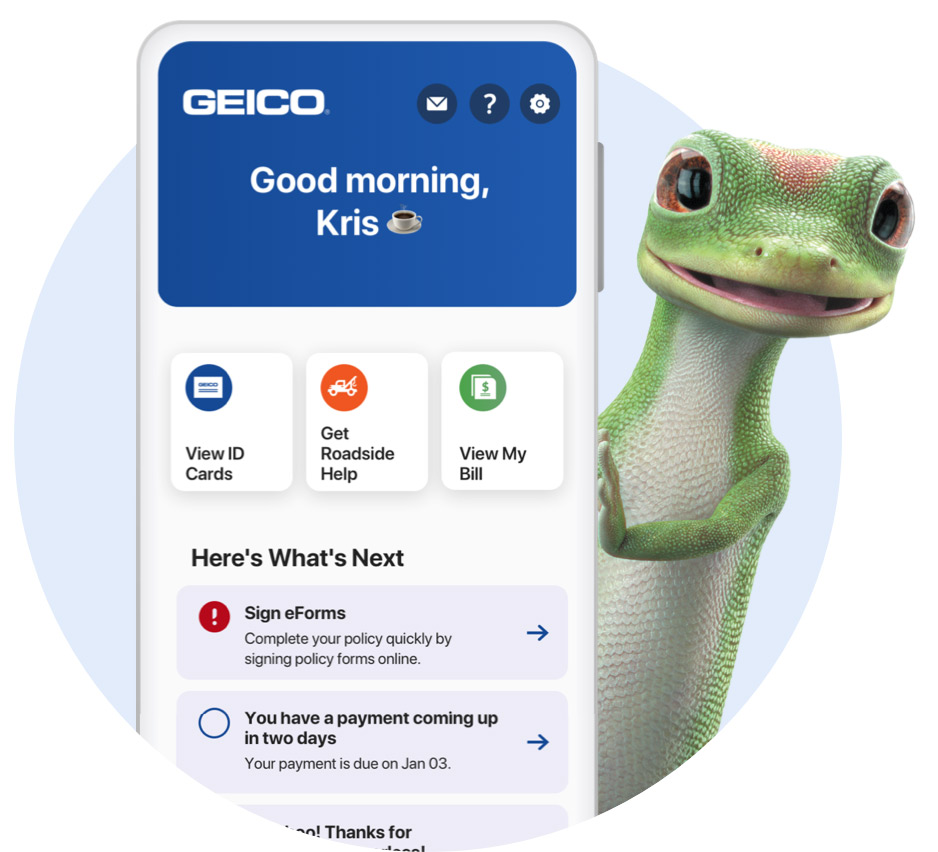

In addition to competitive pricing, Geico excels in customer service, making it a preferred choice for many insured drivers. The company has invested heavily in creating an efficient and user-friendly experience for its policyholders. Notable customer service features include:- 24/7 Availability: Geico's customer support is available around the clock, ensuring assistance is just a call or click away at any time. - Mobile App Functionality: The Geico mobile app allows customers to manage their policies, file claims, and access roadside assistance with ease. - Online Quote System: Prospective customers can obtain quotes quickly through an intuitive online platform, streamlining the decision-making process.“Geico’s customer-first approach ensures that help is available whenever it’s needed, enhancing the peace of mind that comes with being insured.”These features not only improve the overall customer experience but also contribute to Geico's high satisfaction ratings among policyholders.

Geico Discounts and Savings

Available Discounts for Geico Customers, Seguro geico

Geico offers an extensive range of discounts to accommodate different customer profiles. Below is a detailed list of discounts along with their eligibility requirements:- Good Driver Discount: Available to customers with a clean driving record for five years or more.

- Multi-Policy Discount: Offers savings when bundling multiple insurance policies, such as auto and home insurance.

- Military Discount: Provides special rates for active-duty military members and veterans.

- Federal Employee Discount: Available to federal employees and retirees.

- Student Discount: Offered to full-time students under 25 who maintain a B average or better.

- Vehicle Safety Features Discount: Applicable for vehicles equipped with safety features such as anti-lock brakes, airbags, and anti-theft devices.

- New Vehicle Discount: Available for vehicles that are less than three years old.

- Renewal Discount: Given to customers who renew their policies without a lapse in coverage.

- Paperless Policy Discount: For customers who choose to go paperless with their insurance documents.

Eligibility Requirements for Discounts

Understanding the specific eligibility requirements for each discount is crucial to ensure that customers can take advantage of the savings available. Below are the criteria associated with some of the key discounts:- Good Driver Discount: Must have no accidents or major violations within the past five years.

- Multi-Policy Discount: Requires at least two active policies with Geico.

- Military Discount: Verification of active-duty status or proof of veteran status is necessary.

- Federal Employee Discount: Proof of employment or retirement from a federal agency is required.

- Student Discount: Students must provide proof of enrollment and academic performance.

- Vehicle Safety Features Discount: Proof of the vehicle's safety features must be documented.

- New Vehicle Discount: The model year and vehicle must be verified for eligibility.

- Renewal Discount: Customers must maintain uninterrupted coverage without lapses.

- Paperless Policy Discount: Customers must confirm their preference for digital communications.

Potential Savings Table for Different Policy Types

Understanding the potential savings associated with different policy types can greatly influence insurance choices. The table below illustrates estimated savings based on the types of policies and discounts applied:| Policy Type | Base Premium | Discounts Applied | Estimated Savings |

|---|---|---|---|

| Auto Insurance | $1,200 | Good Driver, Multi-Policy | $300 |

| Home Insurance | $800 | Multi-Policy, Paperless | $150 |

| Motorcycle Insurance | $600 | Good Driver, Renewal | $100 |

| RV Insurance | $1,500 | Multi-Policy, Military | $400 |

"By taking full advantage of Geico's discounts, customers can experience significant savings on their insurance premiums, making coverage more affordable."

Claims Process at Geico

Steps Involved in Filing a Claim with Geico

The process of filing a claim with Geico involves several straightforward steps designed to expedite your experience. Knowing these steps can enhance your confidence and ensure you have the necessary information at hand. 1. Contact Geico: Begin by reaching out to Geico through their website, mobile app, or customer service number. This can be done 24/7 for immediate assistance. 2. Provide Details: Be prepared to share essential details regarding the incident, such as the date, time, location, and description of what happened. Accurate information is vital for the claims process. 3. Documentation: Gather any supporting documents, such as police reports, photographs of damages, or witness statements, which may be required to corroborate your claim. 4. Claim Number: After submitting your claim, you will receive a claim number. Keep this number handy for any future reference regarding your case. 5. Assessment: A Geico claims adjuster will review your claim and may contact you for further information or to evaluate damages. 6. Resolution: Once the claim is assessed, Geico will communicate the outcome, including the amount covered and the next steps for repairs or compensation.Tracking Claim Status Online

Geico provides an easy way to monitor your claim's status through their online platform. This feature allows policyholders to stay informed without needing to place a phone call. To track your claim status online, follow these steps: - Log in to your Geico account: Access the Geico website and log in using your credentials. - Navigate to Claims: Once logged in, click on the claims section to find an overview of your active claims. - Select Your Claim: Choose the specific claim you want to track, which will display the latest updates and status information, including any notes from your claims adjuster. This online tracking system provides transparency and peace of mind, allowing you to stay updated at any time.Tips for Ensuring a Smooth Claims Experience

While the claims process can be complex, there are several proactive measures you can take to facilitate a smooth experience. - Document Everything: Keep a detailed record of all communications with Geico, including dates, times, and the names of representatives you speak with. - Be Prompt: Submit your claim and all necessary documents as soon as possible to avoid delays. - Stay Organized: Use a folder or digital tool to organize all related documents, including receipts for repairs and correspondence with Geico. - Follow Up: If you notice that your claim is taking longer than expected, don't hesitate to follow up for updates. - Understand Your Policy: Familiarize yourself with your coverage and the limits of your policy to set realistic expectations regarding the claims process. By following these guidelines, you can help ensure that your claims experience with Geico is as seamless and efficient as possible.FAQ Section

What types of insurance does Geico offer?

Geico provides a variety of insurance options including auto, home, renters, motorcycle, and more.

How can I track my Geico claim?

You can track your claim status online through the Geico website or mobile app by logging into your account.

Are there any special discounts for military members?

Yes, Geico offers discounts for active duty and veteran military members, which can help lower insurance premiums.

How do I file a claim with Geico?

You can file a claim online, via the Geico mobile app, or by calling their claims department directly.

Can I get a quote from Geico online?

Absolutely! You can easily obtain a quote from Geico’s website by entering your information and preferences.

Understanding the importance of health insurance is essential for safeguarding your well-being and financial future. Health insurance protects you against high medical costs, ensuring that you receive necessary treatment without incurring overwhelming debt. When seeking coverage, it's vital to compare plans and understand the terms to find the best fit for your needs.

In addition to health coverage, securing car insurance is crucial for protecting your vehicle and finances on the road. Car insurance not only helps cover repairs after an accident but also provides liability protection in case of injuries or damages to others. Evaluating different policies can help you find adequate coverage that fits your budget and driving habits.